Contents

- What Does “Days in Inventory” Mean?

- What Is the Days in Inventory Formula?

- Example of a Days in Inventory Formula in Action

- What Does the days sales in inventory Outstanding Formula Tell Us?

- Why is Days Sales in Inventory Important?

- How Can I Improve My Days Inventory Outstanding Levels?

- Why Use an Inventory Management Software to Optimize My DIO?

What Does “Days in Inventory” Mean?

The days in inventory ratio, or also referred to as DOI, is a measurement that provides the average number of days or time required for a company to convert its stock into sales. Goods considered a “work in progress” are also included in the inventory for the sake of calculation. This value is calculated by dividing the inventory amount by the number of COGS. After that, the amount achieved is multiplied by the number of days in the relevant period, usually a year.

What Is the Days in Inventory Formula?

The formula for day sales in inventory is quite simple to comprehend. It is the average number of times a business holds its inventory in stock before selling it. This formula represents the speed at which a company can turn its list into cash. While the average days in inventory formula is a liquidity metric, it is also a significant indicator of a business’s financial and operational efficiency. The days in inventory formula goes as follows:

How to Calculate Days in Inventory

Days in Inventory = (Average Inventory Balance / Cost of Sales) x Number of Days in Year (or Period)

In this calculation, the average inventory is calculated by dividing the beginning stock and ending inventory by two. The cost of sales is more commonly known as the cost of goods sold. The days in the period, on the other hand, usually refer to the accounting period decided beforehand, which may vary from a week, a year, or a specific quarter. The ending inventory is based upon the amount of stock the company has left at the end of the year, and it states the value of merchandise that is still up for sale. It can ensure the most accurate calculations by physically counting the leftover inventory at the end of the period that is being examined. That being said, many big-scale companies do not have the time and ability to account for their inventory physically, choosing to work with unique software systems that assist them in inventory management. Ending inventory, often included in the company’s balance sheet, is a crucial metric in defining the company’s liquidity and obtaining financing from investors. Another critical component of the days in inventory formula is the cost of goods sold. This metric refers to the direct price required to produce the inventory being sold. It includes expenses such as raw materials, cost of labor, and similar costs directly related to the production of the goods. Learn more about the COGS formula.

When it comes to choosing a time frame for the days in inventory formula, many businesses prefer to use 365 days to calculate this time for a fiscal year. On the other hand, some businesses choose to use 360 days, especially if they are performing based on quarterly days in inventory calculation of 90 days. This amount is usually decided based on the company’s specific needs and operations.

Example of a Days in Inventory Formula in Action

Here is a days in inventory calculation that may help you understand the days inventory turnover formula a little better:

Let’s say a book store wants to calculate its days in inventory for its latest fiscal year. The store’s balance sheets and financial records state that the business has an ending inventory of $50,000, and its COGS total is $140,000. In this case, the book store can calculate its days inventory outstanding as follows:

50,000 / 140,000 x 365 = 130

This number states that the book store’s days in inventory ratio is 130, meaning that it takes 130 days on average to turn its inventory of books into cash.

What Does the Days Inventory Outstanding Formula Tell Us?

After an example, it’s time to dive into the interpretation of the formula and find out what the days inventory outstanding formula is trying to tell your business. A high day in inventory outcome indicated that your business is not quick enough to turn its inventory into sales. In contrast, low days in inventory numbers signify that your company is doing well in turning over its list into cash. A low DIO usually translates into an efficient business regarding its sales performance and overall inventory management. In contrast, a high DIO signals various adverse outcomes such as poor sales, exceeding the amount of purchased inventory, holding on to the excess amount of stock, or having unwanted, obsolete, and unsellable items. In addition to all of this, the days of stock calculation is an essential metric for the company’s general financial analysis. It is vital to compare your days in inventory numbers to the DIO of your competitors and similar businesses within your industry. While companies operating in the steel industry have average days in inventory levels of 50, a DIO calculation of 6 is considered optimum for companies in the food sector. In other words, it is essential to follow your competitors closely and compare your days in inventory data between companies in the same industry to get a better and more accurate understanding of how well you are doing.

Why is Days in Inventory Formula Important?

The days in sales inventory formula is vital for various reasons since managing your inventory levels on an optimum level is essential for your business regardless of your industry or types of goods or services you sell. Ecommerce businesses nowadays find it more and more challenging to land on accurate stock counts because new customers can come in from all around the globe and complicate the process of predicting solid demand. Companies also have to factor in prime online shopping days, including Cyber Monday and Black Friday. These promotions and similar flash sales may aggravate ensuring the right amount of products are shipped out. Your business may experience multiple delayed or canceled orders, resulting in angry customers without the assistance of accurate projections. It can ultimately serve you with negative feedback for your firm.

By now, we know that the inventory turnover days ratio is one of the most solid and reliable indicators a company has to analyze its efficiency in turning inventory into sales. Therefore, it is safe to say that the days in stock on hand are also a crucial metric in helping the company realize the exact time when to restock its inventory levels. The inventory turnover will be high in case of the inventory days on hand is low.

Tracking your days in inventory levels helps you achieve lower costs, faster profits, and fewer stockouts. Having spot-on days in inventory calculation allows you always to possess the right amount of stock available and come up with accurate reorder check-points when needed. Speeding up the rate at which you deplete inventory means that you are moving your list quicker, giving you room to receive your cash faster as well.

How Can I Improve My Days Inventory Outstanding Levels?

It is known that a lower days in inventory level is always favorable than a higher one. It can reduce this amount in several ways, including lowering the value of inventory held or speeding up the conversion of the stock into sales. The various strategies that businesses use to optimize their days in inventory outstanding levels can be summarized as stated below:

- Deploying more efficient marketing strategies to increase demand

- Increasing the clarity on forecasting and planning to address any wrongdoings between actual and predicted sales

- Using specific techniques such as just-in-time delivery to optimize stock levels

- Speeding up the sales process to convert stock into cash faster

- Offering free shipping or discounts to dispose of slow-selling and obsolete deadstock inventory

It is also important to beware that high days in inventory ratio should not always be considered a problem. Some companies in specific industries deliberately choose to keep their inventory levels high to satisfy an unexpected increase in customer demand. Moreover, the days in inventory numbers may vary at different times of the year in businesses easily affected by seasonal fluctuations in the market.

Why Use an Inventory Management Software to Optimize My DIO?

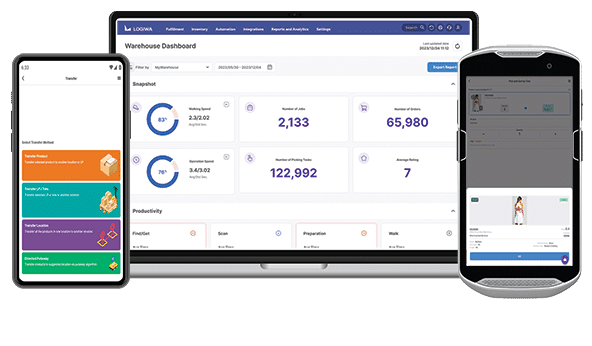

Logiwa’s inventory management software allows your business to get a look at the bigger picture when it comes to your stock levels at any time. Our inventory management software records your actual data about your inventory, including when it has been sourced, ordered, sold, and shipped. Managing cash flow, planning your finances, supervising the flow of your products, and improving the quality of service becomes much easier with the help of these accurate measurements and calculations. By keeping track of the days supply inventory and the products on hand, you can get access to crucial inventory indicators, save both time and money, and turn your impatient stock into a cash flow that will ultimately satisfy both your business and your customers.

FAQs

What is days in inventory ratio?

Days in inventory ratio represents the average time a company keeps its inventory before it is sold. It is also commonly referred to as “Inventory Days of Supply”, “Days Inventory Outstanding” or the “Inventory Period.”

How do you calculate days in inventory?

Days in Inventory = (Average Inventory Balance / Cost of Sales) x (Number of Days in Period)

What is inventory turnover? And how does it differ from days in inventory?

Inventory turnover measures the effectiveness of your company’s inventory management by showing you how quickly your business is able to sell its inventory. Days in inventory shows the average number of days it takes to convert your inventory into sales.

How do you calculate Days Inventory Outstanding (DIO)?

Days Inventory Outstanding = (Average inventory / Cost of sales) x Number of days in period

Adjust quickly to ever-changing fulfillment requirements with the most flexible WMS.

Warehouse Management

Modern digital WMS powers a modern fulfillment experience