Global supply chains have continued to evolve in order to support the expanding, interconnected world of ecommerce. And although international supply chains and consumerism are on the rise, importing and exporting products remain complex.

Businesses managing global imports have faced significant disruptions in recent years, especially in light of lockdowns and pandemic restrictions. Higher duty fees, tariff wars and stricter import standards have also contributed to costly delays.

The U.S. Customs and Border Protection (CBP) law Section 321, Type 86 offers a way to bypass many of these challenges. Commonly referred to as “Section 321,” this law can help you maintain customs compliance while avoiding delays, penalties and operational losses.

For insight into Section 321 programs, risk assessments, entry tests and submission rules, visit: CBP website.

Key Takeaways

- Under Section 321 under the Tariff Act of 1930, fees, taxes and duty requirements for low-value shipments ($800 or less) are waived to simplify and expedite customs clearance.

- There are strict rules regarding Section 321, including: an $800 maximum value cap, the exclusion of certain items, daily shipment limit, and so on.

- Goods coming from China are currently eligible for Section 321 clearance.

- Section 321 provides predictable customs clearance, enhanced supply chain efficiency, cost savings, improved customer satisfaction and other competitive advantages.

- Using Section 321 requires careful documentation, consistent application processes, dependable logistics partners and accurate data management.

Contents

Understanding Section 321 Imports

Section 231 is a provision under the Tariff Act of 1930 which allows U.S. Customs and Border Protection (CBP) to pre-review and approve the classification and valuation of certain imported merchandise. For low-value shipments of $800 or less, Section 321 waives the standard fees and duty requirements typically required for customs clearance.

The reasoning behind this provision is simple: the rise of ecommerce and global fulfillment operations has contributed to heavy shipment traffic at U.S. customs borders. Simplifying clearance for low-value goods helps minimize strains on the U.S. customs service and reduces the occurrence of delays and disruptions for supply chain operations.

Key Aspects of Section 321 Entry

When leveraged correctly, Section 321 makes it easier and less expensive to import stock from other countries. Here are some key factors to keep in mind as you consider leveraging Section 321 entry for international imports:

- There are strict rules around shipment qualification and prohibited items. Some examples include: dangerous chemicals, federally regulated products, items pertaining to Countervailing or Anti-Dumping Duty, cigarettes, cigars and alcohol, etc.

- The $800 value maximum is non-negotiable, meaning that if any part of the shipment’s value exceeds $800, the shipment is not eligible.

- Section 321 can only be applied to one shipment per company each day, and therefore requires strategic planning around how products are bundled and processed.

- Section 321 must be applied correctly to achieve duty-free status. For example, goods must be classified and labeled with the correct Harmonized Tariff Schedule (HTS) code. If incorrect paperwork is submitted, you will face additional penalties and shipment delays.

- Goods coming from China are eligible for Section 321. Despite the current tariffs stemming from the U.S. and China trade war, Section 321 currently supersedes Section 301.

Successfully applying for Section 321 can be challenging, but carefully establishing and following compliant procedures can ensure success.

Benefits of Section 321 Imports

Section 321 offers a cost-effective way to save time and money on U.S.-bound imports. Though it requires extra administrative work and planning, the benefits are undeniable.

Here are some of the top advantages to consider:

1. Predictable Customs Clearance

One of the primary benefits of Section 231 is the predictability it offers in the customs clearance process. By obtaining CBP’s pre-approval for classification and valuation, you can reduce the risk of unexpected delays or disputes during customs clearance on behalf of your business.

2. Enhanced Supply Chain Efficiency

With pre-approved classification and valuation, you can streamline your other supply chain processes. This efficiency not only saves time and safeguards stock but reduces operational costs associated with customs clearance and compliance.

3. Cost Savings

By avoiding disputes and re-evaluations, you can minimize the risk of incurring extra penalties and fines. In addition to reduced tax liability, this can lead to even greater cost savings over time. And as your bottom line is enhanced, you are able to invest in even more cost-saving technologies, resources and strategies.

4. Improved Customer Satisfaction

Efficient supply chain operations lead to reliable stock levels, reduced costs (to you and customers) and on-time deliveries. This, in turn, enhances customer satisfaction and brand reputation as consumers can trust that their orders will arrive as expected.

5. Competitive Advantage

Utilizing Section 231 offers a competitive edge for global businesses. It supports quicker and more supply chain operations, which leads to stable business growth, new partnerships and happier customers. By being able to receive items sooner, you are able to stabilize stock, fulfill orders faster, avoid stockouts and even obtain new products before your competitors.

Accelerated customs clearance and optimized logistics results saves time and money. Moreover, it helps move products efficiently to fulfillment centers and on to end customers with greater ease. Embracing Section 231 facilitates streamlined fulfillment and can enhance overall business success in the global marketplace.

How to Claim Section 321 Shipments

In some cases, a commercial invoice showing less than $800 worth of item value may automatically invoke Section 321 clearance for shipments. But that is not guaranteed, especially if customs suspects the products present within the shipment violate guidelines. It is therefore important to provide detailed paperwork to your couriers and the U.S. CBP.

To apply for Section 231, you can submit a detailed application or Section 321-labeled shipping manifest via eManifest/ACE Manifest given to the U.S. CBP. This will include information about the products being shipped (e.g. quantity, point of origin, classification, etc.), the valuation of the shipment, relevant consignees, shipping carrier details and more.

Finding the best way to apply for Section 321 depends on the products and mode of transportation being used. Once you’ve determined the best avenue for your business – whether that be through the ACE Secure Data Portal, using an EDI, or another approved method – you can submit your various documents and forms directly to the U.S. CBP.

Tips for Successful Section 321 Customs Clearance

In the world of international trade, compliance with customs regulations is a fundamental requirement for success. Section 231 provides an invaluable way for businesses to enhance their supply chain operations, improve cost-savings, and ensure smoother customs clearance processes.

Consider the following best practices for ensuring Section 321 success:

- Check Applications and Shipment Documentation – Accuracy and completeness are crucial, as any errors or omissions can lead to delays or rejections. Before submitting your application, take care to review the information on your applications, and re-confirm with your suppliers, manufacturers, and shippers that packing standards have been met.

- Seek Expert Assistance – Navigating the complexities of customs regulations can be challenging. To benefit from Section 231, consider enlisting the help of experts such as customs brokers, attorneys, or consultants who specialize in customs compliance. They can guide you through the application process and ensure that you meet all requirements.

- Maintain Accurate Records – CBP may request documentation to support your application. Keeping meticulous records of your products, their pricing, and any related documents will expedite the process and help you maintain compliance. You will also want to maintain visibility over shipping timelines to ensure multiple shipments do not claim Section 321 status on the same day.

- Communicate Changes Promptly – If there are any changes in your imported products, classification, or valuation, it’s essential to communicate these changes to CBP promptly. Failing to do so may lead to compliance issues and penalties.

- Work with Dependable Logistics Partners – You need to ensure your business is working with suppliers, freight forwarders, and international carriers who can be trusted to support Section 321-compliant processes. To avoid financial penalties and delays, make sure you and your partners are all on the same page.

Streamlining Section 321 Shipments and Shipping Logistics

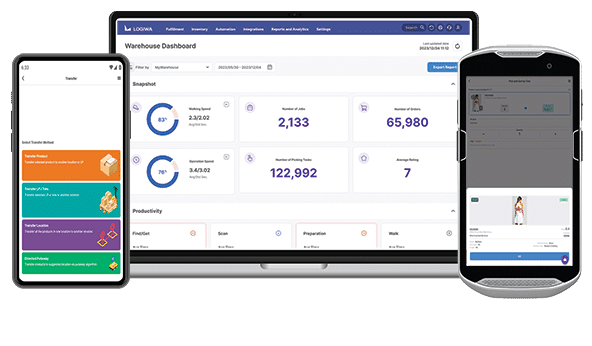

By leveraging Section 321, operations can enjoy greater supply chain predictability, efficiency, cost savings, and customer satisfaction. As a leading WMS and fulfillment solutions provider, Logiwa WMS seeks to help our customers take those efficiencies even further.

Logiwa works directly with retailers, fulfillment networks and third-party logistics (3PL) providers to support and optimize each aspect of fulfillment – including shipping logistics. From powerful shipping automation capabilities to tools like rate shopping (which guarantees the lowest rates by total cost or by delivery date), customers are able to maximize cost-savings and operational efficiency.

Learn more by scheduling a demo today.

FAQs Related to Section 321 Customs Clearance

What is a Section 321 shipment?

It is a type of low-value shipment of $800 or less, that the U.S. Customs and Border Protection (CBP) waives standard fees, taxes and duty requirements for – which helps expedite customs clearance and minimize shipping costs for businesses.

What are the restrictions of Section 321?

There are strict rules regarding shipment, including: an $800 cap on shipment value, the exclusion of prohibited items and those tracked by federal agencies, and a maximum daily use per company (one shipment per day).

What are the benefits of Section 321?

Leveraging Section 321 provides predictable customs clearance, enhanced supply chain efficiency, cost savings, improved customer satisfaction and other competitive advantages for businesses. It also helps to minimize delays and disruptions for U.S. customs border operations.