In this article, you’ll discover the ins and outs of shipping insurance from a business owner’s perspective, gaining insight into its importance, how it works, its cost, and whether it is a worthy investment. You’ll be able to weigh the benefits and drawbacks of shipping insurance to make an informed decision, learn about different scenarios related to shipping, and get tips to streamline your shipping operations and minimize risks.

Key Takeaways:

- Shipping insurance provides financial protection against the loss or damage of items during transit, potentially saving your business from considerable losses.

- The cost of shipping insurance is directly proportional to the value of items being shipped, with different carriers offering varying rates.

- While shipping insurance does incur an additional upfront cost, it may lead to long-term savings by covering the cost of replacements for lost or damaged items.

- A decision about shipping insurance should be based on a careful analysis of potential risks and costs related to your specific business operations.

- Despite the cost, shipping insurance can help maintain customer satisfaction, potentially leading to positive reviews and repeat business.

As the owner of a business, large or small, you’re going to end up dealing with shipping. Whether you’re receiving goods or shipping goods, there are certain things you’ve likely encountered when it comes to shipping.

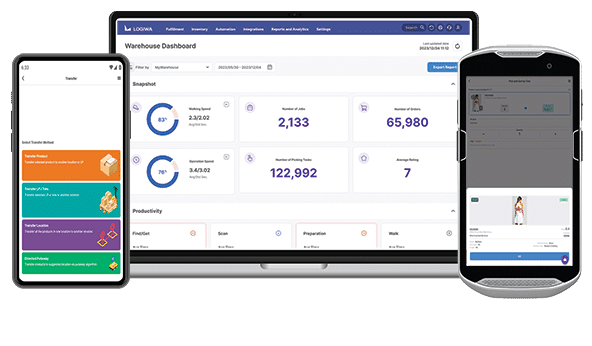

One of these things might be shipping insurance. Whether you’re using a warehouse management system to handle your shipping needs or different order fulfillment software, shipping insurance is something to look into.

Shipping insurance can go a long way towards protecting your assets and profits! You will be able to ship lots of products and not have to worry if they don’t arrive or if they arrive damaged.

This can save you time, energy, and money, and it can also lead to positive reviews from customers.

In this guide, we’ll explore:

What Is Shipping Insurance?

Shipping insurance isn’t too far removed from other types of insurance. The insurance is there to help if anything goes wrong during the shipping process. If the item you’re shipping gets lost or damaged while in transit, shipping insurance will help to protect what you’ve spent and to ensure you receive enough funds to cover a replacement shipment.

In simpler terms, this means that you won’t lose out (in money or products) if you use shipping insurance. Although it may increase the shipping cost, it will pay big dividends down the road.

Look at the two following scenarios:

Scenario 1

-

- The buyer buys a product from your store or shop – congratulations!

- You ship the item with the packing slip to the buyer. You make sure to ship it with shipping insurance included.

- The package gets lost on the way to the buyer – oh no!

- You tell the shipping provider you worked with and get reimbursed for the shipment (that they lost).

- You send out a replacement for the lost order (with insurance again), using the reimbursement you got from the shipping provider to pay for the new shipment.

- The product arrives safely at the buyer’s house and they leave you a good review.

This is a perfect interaction, and the best thing one can wish for as a seller. On the other hand, look at the following scenario:

Scenario 2

-

- The buyer buys a product from your store or shop – congratulations!

- You get a shipping label and ship the item to the buyer, but you opt not to include insurance.

- The package gets lost on the way to the buyer – oh no!

- Because you didn’t buy insurance, the shipping provider doesn’t reimburse you any money.

- Unless you want to get a bad review from the buyer, you’ll end up having to replace and ship the item out of pocket, which will eat into your profits.

- Unfortunately, this means that at the end of the transaction, you will have lost more money than you wanted to.

As a business owner, which one seems more beneficial to you? It’s scenario 1. Shipping insurance will help you to protect your money and to keep your customers happy!

How Does Shipping Insurance Work?

As with all insurance, shipping insurance works in such a way that you pay ahead of time to not have to pay money on the other end of it. What this means – in practice – is that you will initially spend more money when you ship an item to protect against loss, theft, and damage.

If you end up shipping an item and the recipient wants to return it or they claim it arrives damaged or anything, shipping insurance will protect the buyer and you, as the recipient.

In essence, shipping insurance works so that you’re paying whatever shipping service you work with to give you money back because they lost or damaged the item.

As mentioned, you will be paying ahead of time to be reimbursed in case the item gets lost or damaged in service. If you don’t get shipping insurance and the package gets lost or if it arrives damaged, you will be forced to either:

- Send the buyer a replacement item free of charge (which means that you will have to eat twice the production costs for a single item).

- Receive a bad review from the customer if you refuse to send them a replacement item.

- Have to refund the purchase to the buyer, which means that – although the buyer might not leave you a bad review – you will lose out on any shipping costs, production costs, and any profit from the sale.

Shipping insurance will save you money and it will save you profit.

Why Is Shipping Insurance Important?

Shipping insurance is important because it can provide you with insurance and relief. You won’t have to worry too hard about if the item gets lost or broken in travel. It can help make sure you get the profits you deserve for your sales.

Shipping insurance is one of the best services that sellers can pay for to provide security for both the buyer and the seller.

How much does shipping insurance cost?

The price of shipping insurance for all carriers is directly proportional to the value of the items being shipped. As the value of the items increases, so does the cost to insure the package. For specifics on how much shipping insurance would cost with UPS, Fedex, and USPS, see the tables below:

USPS Insurance Costs: USPS Rates

| Merchandise Value | USPS Insurance Cost* |

| Up to $50.00 | $2.65 |

| $50.01 – 100.00 | $3.40 |

| $100.01 – 200.00 | $4.30 |

| $200.01 – $300.00 | $5.65 |

| Maximum liability of $5,000.00 | $11.50 plus $1.75 per $100.00 over $600.00 |

FedEx Insurance Costs: FedEx Rates

| Merchandise Value | FedEx Insurance Cost* |

| Up to $100 | Included in shipping rate |

| $100.01 – $300.00 | $3.00 |

| Maximum liability of $2,000.00 | $1 per $100 of declared value over $300 |

UPS Insurance Costs: UPS Rates

| Merchandise Value | UPS Insurance Cost* |

| Up to $100 | Included in shipping rate |

| $100.01 – $300 | $3.90 |

| Maximum liability of $1,000 when shipped via a third-party retailer | $1.30 per $100 of declared value over $300 |

*Insurance rates can change often. You can find current rates by using the links provided.

Is Shipping Insurance Worth It?

That depends! If you’re looking for additional security and to not be so liable . . . as well as happier customers, it might be worth your while. Keep in mind that all these benefits will come at a higher price, however. You will be forced to pay more money to have peace of mind when it comes to shipping.

However, if you decide against getting shipping insurance, make sure you’re aware of what problems you might be inviting.

These problems might be, but aren’t limited to:

-

- Buyers claiming that the package arrived damaged or otherwise, and then expecting you to send a replacement item.

- Items actually arriving damaged – or not arriving at all – forcing you to send a replacement item and pay for it out of pocket.

There are other reasons you might regret not buying shipping insurance, but those are the two main ones. At the end of the day, the largest reason to buy insurance is to keep more money in your pocket.

Although you might have to pay more upfront, you’ll save money on replacements and lost items. Weigh the pros and cons of choosing insurance versus what it might cost you to have to replace the items . . . and then take those factors and use them to make your decision.

Ready to streamline your shipping process and minimize the risks associated with lost or damaged goods? Discover how Logiwa’s Smart Shipping software can take the stress out of your shipping operations. Request a demo today!

Let’s convert your warehouse to a B2C fulfillment engine. We’ve added new features to help achieve full profitability in your business. Schedule a Demo

FAQs

Is shipping insurance worth getting?

Unfortunately, this isn’t the type of question that has an easy answer. You need to decide whether shipping insurance is important to you depending on your specific needs and budget. Weigh the costs, the pros, and the cons of shipping insurance, and then make your decision.

How much does it cost to insure a shipment?

Unless you have a relationship with a shipping provider, the cost of insuring a shipment will vary depending on the value of what you’re shipping. The more expensive the item that you’re shipping, the more that shipping services will charge you to insure your shipment. The shipping services will charge you more for higher-priced items because they will be forced to spend more on their end to reimburse you should the item get lost or arrive damaged.

Who is responsible for shipping insurance?

When it comes to shipping insurance, there isn’t a hard and fast rule for who should pay the shipping insurance. Realize that if you force the buyer to pay it, they might decide against doing so. In this case, if the package is lost, damaged, or stolen, although you won’t be under any obligation to replace the item, realize that there will be an expectation from the customer that you will do so anyway.

Although you aren’t obligated, realize that refusing to replace their item might result in a bad review from them. As such, many sellers will take on the cost of shipping insurance so that they can replace the item and also not lose out on shipping the item.

How do I ensure that a package is shipped?

The best way to ensure that a package is shipped and that it is making its way safely to the recipient is to make sure that you have tracking attached to the shipment. Most shipping services will automatically provide it and some may charge a fee for tracking.

Whatever the cost, making sure that you have tracking information is the best way to not get scammed by customers who claim they never got a product and ask for a replacement.

How Does Shipping Insurance Operate?

Shipping insurance functions by offering you an upfront payment mechanism to avoid possible financial losses at the end of the shipping process. It safeguards your product from loss, theft, and damage during transit. If any of these issues occur, the shipping insurance covers the cost, protecting both the buyer and the seller.

What is Shipping Insurance?

Shipping insurance is a protective measure you can opt for during the shipping process. It’s designed to provide financial coverage if the shipped items get lost or damaged during transit. This coverage ensures that you don’t lose out on your money or products, making it a valuable precaution, despite potentially increasing the shipping cost.

What Does Shipping Insurance Typically Cover?

Shipping insurance covers loss, theft, and damage of items during transit. It ensures that in the event of such issues, the seller can get a reimbursement from the shipping provider, thereby protecting their profits and assets. This means that if a package goes missing or arrives damaged, the seller doesn’t bear the financial burden of replacing the items.

Adjust quickly to ever-changing fulfillment requirements with the most flexible WMS

3PL

Cloud 3PL software for high-volume fulfillment excellence